Navigating Success in 2025: Innovative Strategies for ASCs to Thrive in a Changing Landscape

Navigating Success in 2025: Innovative Strategies for ASCs to Thrive in a Changing Landscape

By: Traci Albers, CEO

The ASC industry is set to succeed in 2025; it will need innovative thinking and a new approach to age-old challenges. I have worked in the ASC industry for over twenty years, and I am as optimistic today as I was when I first started. We have faced challenges over the years, and one thing I know about the ASC industry is that we have risen to those challenges in an effort to continue delivering high-quality, cost-effective care to the communities we serve. As you look to 2025, the focus must remain on case volume growth, revenue enhancement, and expense management. Stay focused on the basics; at the same time, remain apprised of industry news and what is happening in your market.

- Case Volume Opportunities: As the number of independent physicians continues to decline and physicians retire from practice, we need to remain steadfast in our approach to increasing case volume.

-

- New Physician Recruitment: If you are in a market with independent physicians, you must continue to deliver a high-value ASC that demonstrates high efficiencies and a strong return on investment. Your weekly schedule should include time set aside for new physician outreach and marketing efforts.

- Other Partnership Opportunities: There are many partnership opportunities available to ASCs. Evaluating ones that will benefit your ASC, drive volume, and not disrupt your culture is critical. Health systems are investing in outpatient strategies. Private equity has a strong presence in our industry. Management companies are also poised for investment opportunities and support in other areas of operations. Partnerships can be helpful with case volume growth and new capital; however, you need to evaluate the partners carefully, assessing what they truly can provide both in the short term and long term.

- Employer-Direct Strategies: Employers are evaluating ways to reduce health insurance costs, especially if they are self-insured. There are opportunities for ASCs to drive value and partner more closely with self-insured employers. There are management companies who have experience in this area.

- Marketing Presence: ASCs have historically focused efforts on surgeons and proceduralists, but with the ever-pervasive presence of social media and tech-savvy consumers, they need to ensure their brand and market presence are well represented. Strategizing with a marketing firm that understands the healthcare industry and where marketing dollars should be spent is critical.

- Revenue Enhancement: Your revenue cycle and payer contracting strategies are imperative for your ASC’s success:

- Payer Contracting: It has become increasingly difficult to affect change from payers. Many articles are being published that discuss “value-based care”, “site of service” care, and other buzzwords that point to the fact that payers are interested in moving patients to the most appropriate site of service. In reality, this has not translated to conversations and meaningful dialogue about adequate payment for ASCs. If you are an independent ASC and are not spending the requisite time on payer contracting, you could fall behind on your rates. Make 2025 the year where you complete a thorough analysis of your payer rates and develop a strategy to impact and/or improve upon those. It requires time, attention, and data to compel the payers to change.

- Revenue Cycle Review: You need to monitor key benchmarks to ensure your revenue cycle is performing optimally. In addition, if you have not had an external coding and billing audit within the last several years, 2025 would be a good time to validate your processes and how your team and/or partner are performing.

- Expense Management Opportunities: Due to various factors, ASCs face tighter margins each year. The days of easily identifying low-hanging fruit for cost-cutting are over. ASCs must now dig deeper and assess options that they previously did not need to consider.

-

- Anesthesia Costs: The shortage of anesthesia providers is driving increasing costs in many markets. That, coupled with declining reimbursement, has impacted ASCs. In many markets, ASCs are subsidizing anesthesia to provide services at their facilities. This requires ASCs to evaluate room utilization, anesthesia models, anesthesia billing and coding, and all facets of anesthesia expenses and revenue. While the problem cannot be fully solved, it will require ASCs to think differently about the delivery of anesthesia care.

- Staffing Challenges: Gone are the days when there were plenty of nurses, surgical technologists, and radiology technologists. If you manage to find these skilled workers, you are also paying more than ever. If you have not already implemented in-house training programs, you must begin to do so in 2025. It is not sustainable to rely on contract or traveling staff in the long term. Additionally, you need a 5 to 10-year plan for staffing your facility. Besides “growing your own,” you should also think creatively about the types of workers needed to fulfill every role. Certified nursing assistants can provide significant support in an ASC and help relieve some of the workload from the nursing staff, for example.

- Supply Costs and Availability: If 2020 and 2024 have taught us anything about the supply chain, it’s that you need a strategy to mitigate costs while also incorporating redundancies to prevent potential shortfalls. ASCs are engaging in challenging discussions about the best ways to proactively plan for future shortages. Additionally, the fluid shortage has provided insights on how to operate more efficiently and reduce fluid Usage. While ASCs have traditionally relied on just-in-time inventory, there might be a case for maintaining extra supplies on your shelves to help guard against potential shortages. This is a risk/benefit analysis your management team and GPO partner should be undertaking now.

- Cybersecurity and Risk Mitigation: Cybersecurity risk remains a significant concern for ASCs. Not only do you face increased risks within your own ASC systems, but you are also vulnerable to risks posed by third-party vendors. If you have not yet conducted a cybersecurity or HIPAA security risk assessment, make sure this is on your agenda for 2025. It is essential to identify your areas of weakness and determine where to strengthen efforts to mitigate the risk of a cyberattack or HIPAA breach.

- Technology Costs: Technology has enabled ASCs to perform procedures that were not possible years ago. However, this new technology brings increased costs. Additionally, there is software available to streamline any operational processes you may require. Any new technology should be assessed for upfront costs, ongoing expenses, and the value it brings to stakeholders. Furthermore, you should evaluate any staff savings associated with the implementation of the respective technology. Incremental technology costs can gradually accumulate and become a significant portion of your budget. Remain diligent in your ongoing review of the value provided by all technologies.

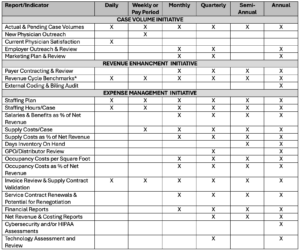

As you look toward 2025, ensure you have daily, weekly, monthly, and annual reports, along with key measures that you are reviewing, so you can develop strong action plans to address the ongoing challenges of case volume growth, revenue enhancement, and expense management. If you haven’t developed your 2025 strategic plan yet, it’s not too late to analyze your strengths, opportunities, weaknesses, and threats. This blog has provided the first step toward that 2025 plan. In addition, we’ve offered a tool to help you monitor the right indicators for measuring your success. It’s also vital that you not only monitor these indicators but also evaluate them over time for trends.

To help you with these, refer to the chart

*There is multiple revenue cycle benchmarks and reports your ASC should be monitoring.

*There is multiple revenue cycle benchmarks and reports your ASC should be monitoring.